venmo tax reporting for personal use

This income will be reported. Once you are ready to file your taxes various online services can help.

New Irs Rules For Cash App Transactions Start Next Year Wfmynews2 Com

If this number was met.

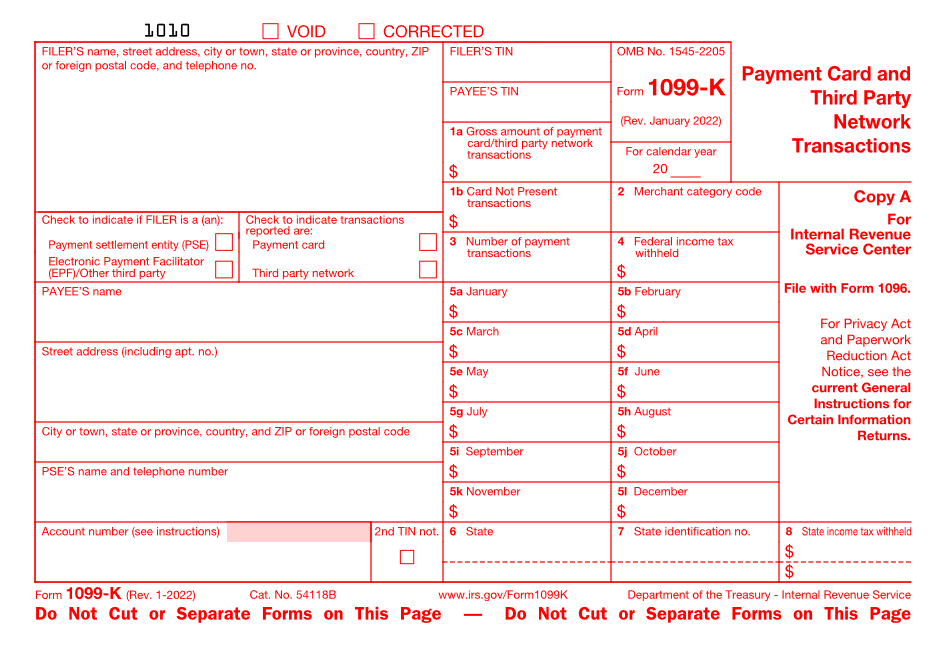

. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. Businesses using Venmo to pay employees should be sure to issue them a 1099-MISC form especially if you pay them more than 600 a year. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to.

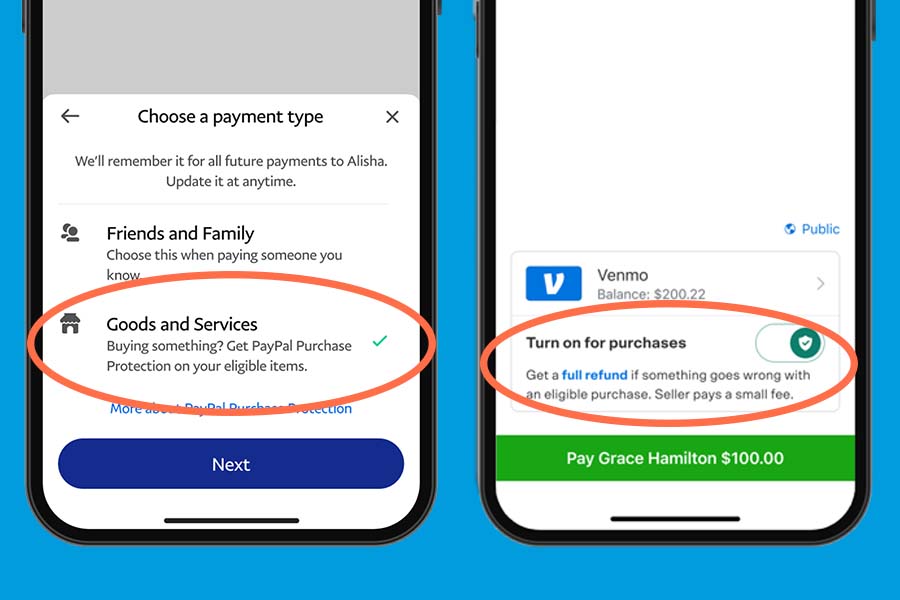

The best way to avoid having personal transactions reported to the IRS is to use separate. If you use PayPal Venmo or other P2P platforms. Rather small business owners independent.

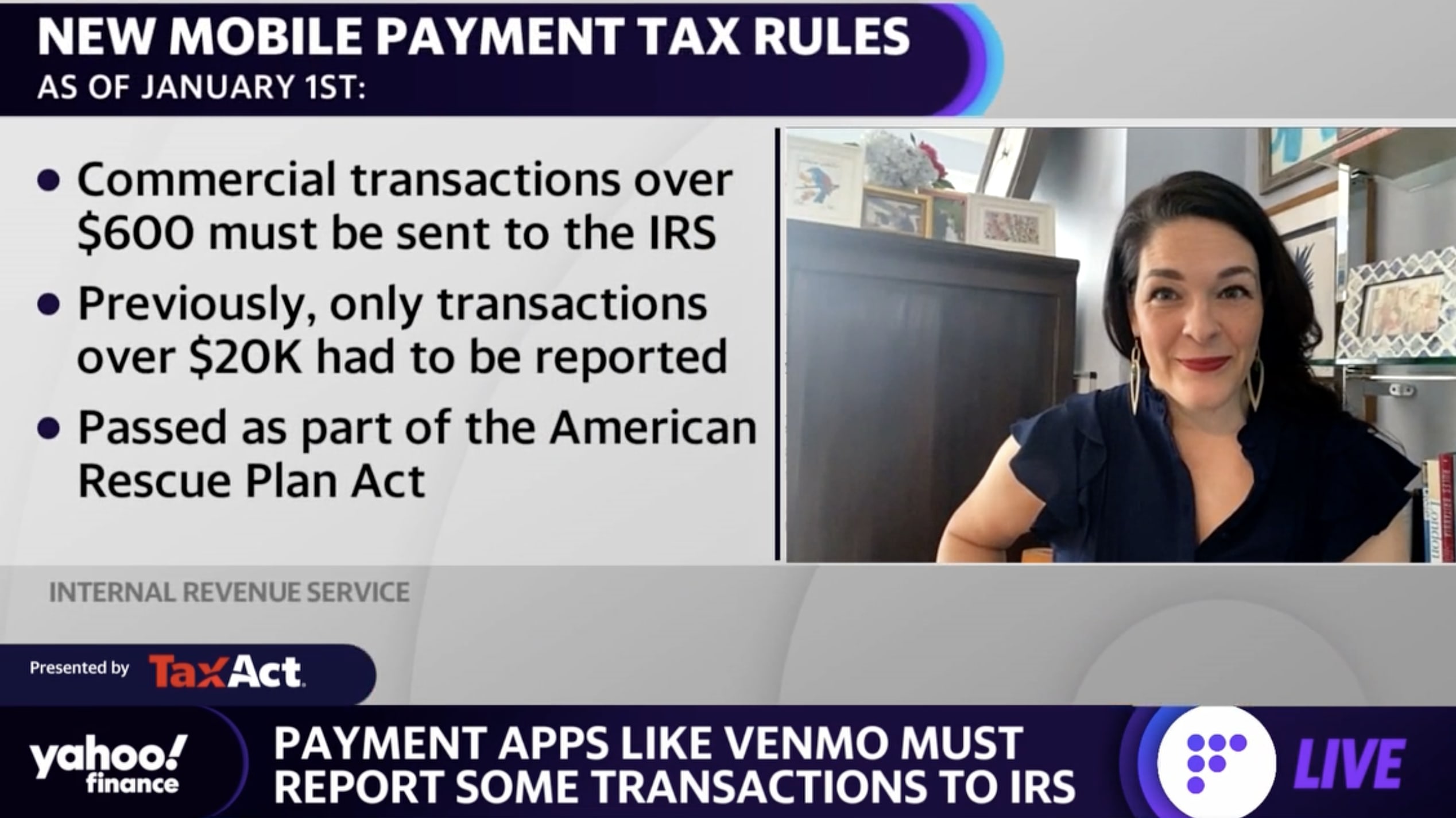

Business owners using sites like PayPal or Venmo now face a stricter tax-reporting. Prior to this legislation third-party payment platforms would only report to the tax agency if a user had more than 200 commercial transactions and made more than 20000 in. For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence.

The IRS is not requiring individuals to report or pay taxes on. By Tim Fitzsimons. Instead reporting requirements for third-party payment services and apps such as Venmo and PayPal for taxes have changed.

The tax code allows you to deduct certain costs of doing business from gross income. But Venmo tax reporting laws have changed and this change applies to all other P2P apps too. In 2022 Venmo PayPal and Cash App are required to.

The new Venmo income reporting rules apply to an aggregate of 600 or more in income on goods or services through the calendar year. A business cant use a personal account because it doesnt provide the necessary tax records. The IRS views the payment andor receipt of money through Venmo or any similar peer-to-peer P2P app the same as a traditional payment andor receipt of cash.

Rather small business owners independent. Venmo also has a 2022 Tax FAQ and an explainer on what else you can expect this tax season. Before 2022 the minimum threshold for reporting business transactions in a tax year was 20000 in gross payments and more than 200 transactions.

You may only have one personal account. Use the Right Tax Form. Businesses are still required to report any payments received through Venmo and PayPal as taxable income when filing taxes.

For the current or the old tax rule on 1099-K tax. Aug 18 2022 venmo tax reporting for personal use 2022 Thursday. For most states the threshold.

The only difference that you should see in 2023 is. We offer accounts for two types of purposes. Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year.

1099-NEC Used to report on the 1099-MISC Remember that the Internal Revenue Service still requires you to report your income for goods or services even if you didnt receive 20000. Tax Reporting for Payments of 600 or More. For example a taxpayer who uses their car for business may qualify to claim the.

To create a personal account. A business transaction is. Personal accounts and approved business accounts.

Now in addition to freelancers and.

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

New Law Impacting Peer To Peer Payment App Users

New Tax Law Venmo Cash App To Report Business Transactions Over 600 Wrvo Public Media

Taxes What To Know About Irs Changes For Payment Apps Like Venmo Paypal

Does The Irs Want To Tax Your Venmo Not Exactly

Do You Have To Pay Taxes On Fundraiser Money

Press Release New U S Tax Reporting Requirements Your Questions Answered

Beware Of New Tax Rule Affecting People Who Use Venmo Paypal Or Other Payment Apps Tax Attorney Orange County Ca Kahn Tax Law

If You Dread The Irs Now Wait Until You Get A 1099 K Wsj

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

New Reporting Requirements For 1099 K

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

The Irs Is Not Taxing Venmo Zelle Cash App Transactions Khou Com

1099 K Changes What Do They Mean For Your Side Hustle Ramseysolutions Com

Businesses Accepting Venmo And Other Digital Payments Need To Be Aware Of New Tax Reporting Requirements Anders Cpa

Do I Have To Issue 1099s To Independent Contractors Paid Via 3rd Party Vendors Updated 4 5 22

Irs Tax Reporting Changes Coming To Apps Like Venmo Zelle

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

If You Use Venmo Paypal Or Other Payment Apps This Tax Rule Change May Affect You